Mediator

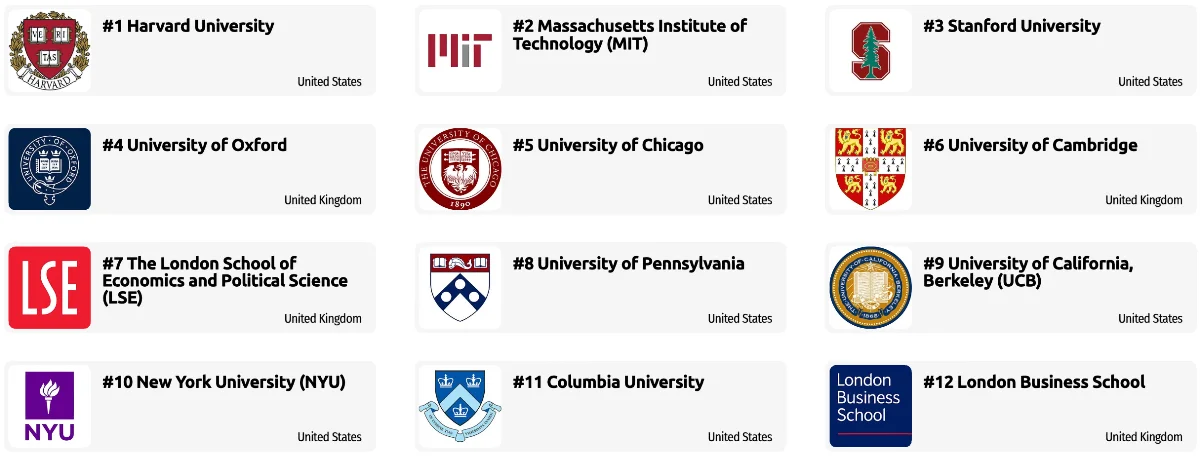

Mediators should be capable of:

- Providing personal assistance, medical attention, emotional support, or other personal care to others such as coworkers, customers, or patients.

- Developing constructive and cooperative working relationships with others, and maintaining them over time.

- Performing for people or dealing directly with the public. This includes serving customers in restaurants and stores, and receiving clients or guests.

- Handling complaints, settling disputes, and resolving grievances and conflicts, or otherwise negotiating with others.

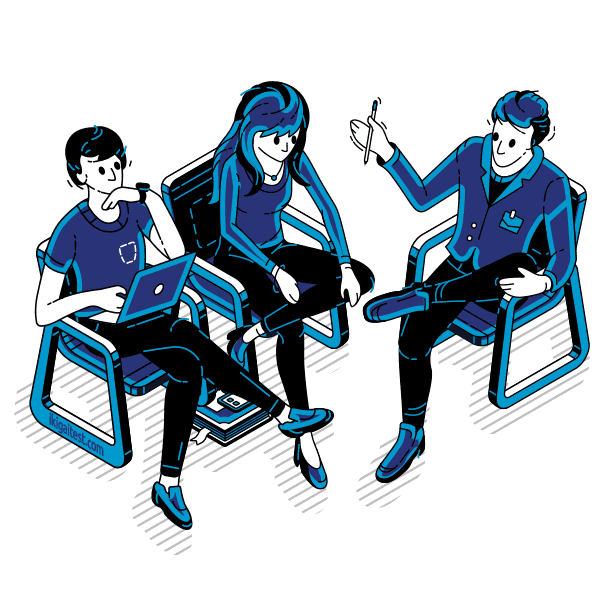

Inspector

Inspectors should be great at:

- Estimating sizes, distances, and quantities; or determining time, costs, resources, or materials needed to perform a work activity.

- Observing, receiving, and otherwise obtaining information from all relevant sources.

- Identifying information by categorizing, estimating, recognizing differences or similarities, and detecting changes in circumstances or events.

- Inspecting equipment, structures, or materials to identify the cause of errors or other problems or defects.

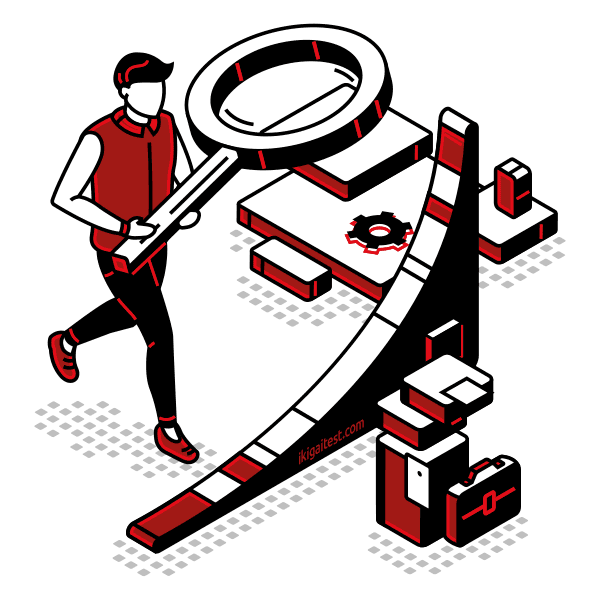

Other work activities related to Loan counselors

- Advising students on available financial aid awards.

- Providing students with counseling on entrance or exit loans.

- Checking loans agreements for ensuring that they are completed and accurate, according to policies.

- Referring loans to loan committees for approval.

- Approving loans within specified limits.

- Submitting applications to credit analysts for verification and recommendation.

- Analyzing applicants’ financial status, credit, and property evaluations for determining feasibility of granting loans.

- Interviewing applicants and requesting specified information for loan applications.

- Establishing payment priorities according to credit terms and interest rates for reducing clients’ overall costs.

- Contacting applicants or creditors for resolving questions about applications or to assisting with completion of paperwork.

- Maintaining current knowledge of credit regulations.

- Calculating amount of debt and funds available for planning methods of payoff and for estimating time for debt liquidation.