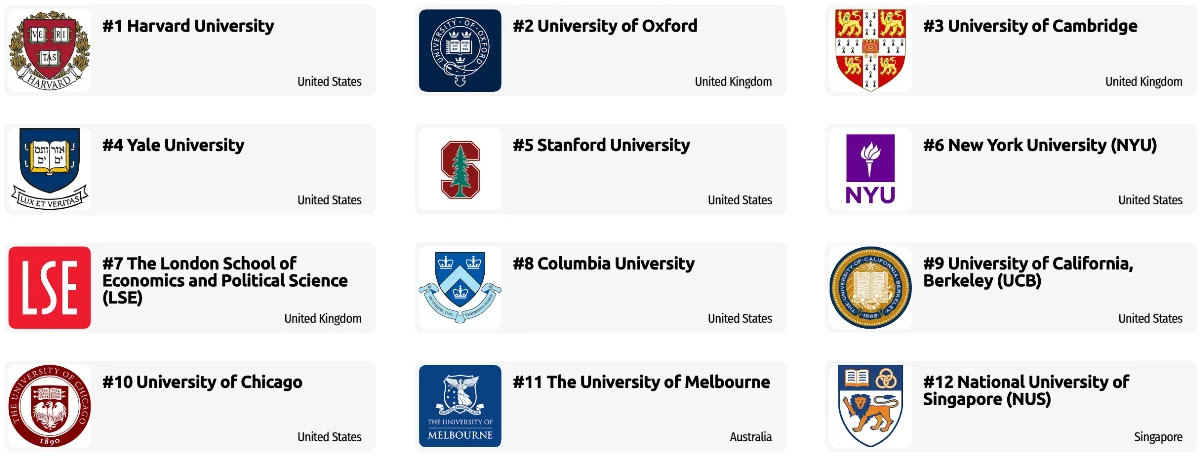

Inspector

Inspectors should be great at:

- Estimating sizes, distances, and quantities; or determining time, costs, resources, or materials needed to perform a work activity.

- Observing, receiving, and otherwise obtaining information from all relevant sources.

- Identifying information by categorizing, estimating, recognizing differences or similarities, and detecting changes in circumstances or events.

- Inspecting equipment, structures, or materials to identify the cause of errors or other problems or defects.

Analyst

Analysts will often perform the following tasks:

- Identifying the underlying principles, reasons, or facts of information by breaking down information or data into separate parts.

- Using relevant information and individual judgment to determine whether events or processes comply with laws, regulations, or standards.

- Assessing the value, importance, or quality of things or people.

- Compiling, coding, categorizing, calculating, tabulating, auditing, or verifying information or data.

Other work activities related to Investment underwriters

- Structure marketing campaigns for finding buyers for new securities.

- Supervising, training, or mentoring junior team members.

- Assessing companies as investments for clients by examining company facilities.

- Preparing all materials for transactions or execution of deals.

- Performing securities valuation or pricing.

- Employing financial models for developing solutions to financial problems or for assessing the financial or capital impacts of transactions.

- Developing and maintaining client relationships.

- Evaluating capital needs of clients and assessing market conditions for informing structuring of financial packages.

- Coordinating due diligence processes and the negotiation or execution of purchasing or sale agreements.

- Conferring with clients to restructure debt, refinancing debt, or raising new debt.

- Analyzing financial or operational performance of companies facing financial difficulties for identifying or recommending remedies.

- Advising clients on aspects of capitalization, such as amounts, sources, or timing.