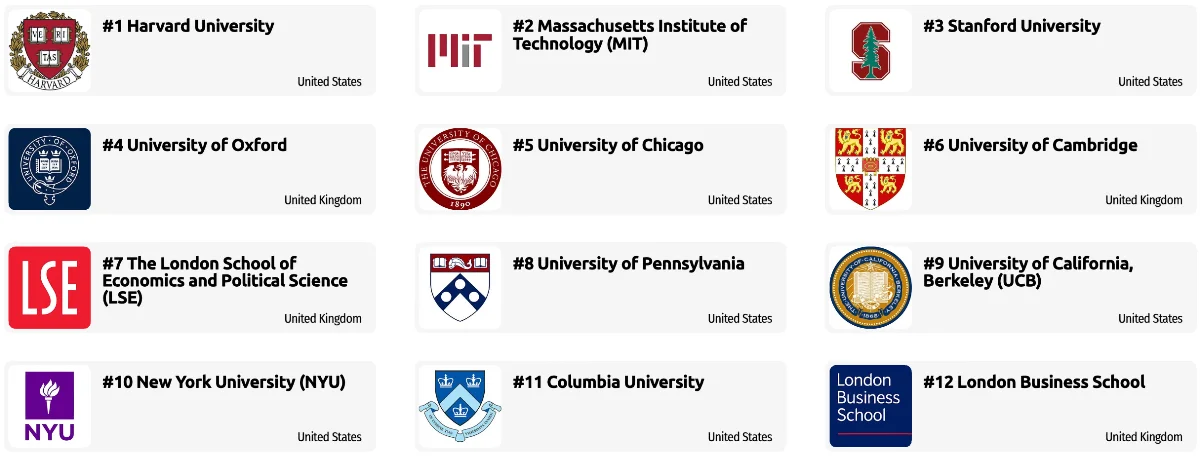

Inspector

Inspectors should be great at:

- Estimating sizes, distances, and quantities; or determining time, costs, resources, or materials needed to perform a work activity.

- Observing, receiving, and otherwise obtaining information from all relevant sources.

- Identifying information by categorizing, estimating, recognizing differences or similarities, and detecting changes in circumstances or events.

- Inspecting equipment, structures, or materials to identify the cause of errors or other problems or defects.

Innovator

Innovators will usually have four main goals:

- Developing or creating new applications, relationships, systems, or products.

- Providing creative ideas or artistic contributions.

- Keeping up-to-date technically and applying new knowledge to your job.

- Benchmarking, experimenting and testing novel approaches to solving problems.

Other work activities related to Tax preparers

- Answering questions and providing future tax planning to clients.

- Explaining federal and state tax laws to individuals and companies.

- Computing taxes owed or overpaid, using adding machines or personal computers, and completing entries on forms, following tax forms instructions and tax tables.

- Preparing or assisting in preparing simple to complex tax returns for individuals or small businesses.

- Using all appropriate adjustments, deductions, and credits for keeping clients’ taxes to a minimum.

- Interviewing clients for obtaining additional information on taxable income and deductible expenses and allowances.

- Reviewing financial records such as income statements and documentation of expenditures for determining forms needed to preparing tax returns.

- Furnishing taxpayers with sufficient information and advices for ensuring adequate tax forms completion.

- Consulting tax law handbooks or bulletins for determining procedures for preparation of atypical returns.