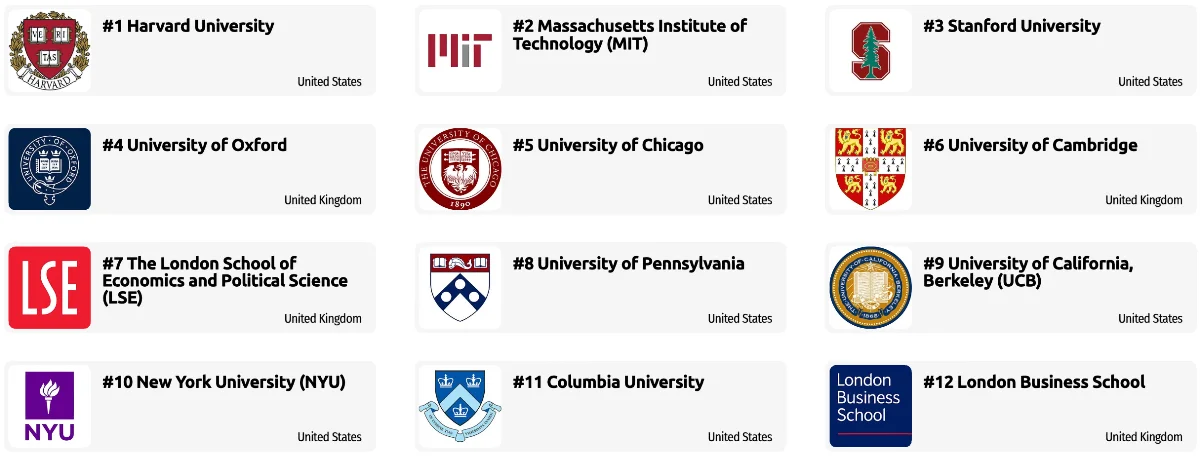

Inspector

Inspectors should be great at:

- Estimating sizes, distances, and quantities; or determining time, costs, resources, or materials needed to perform a work activity.

- Observing, receiving, and otherwise obtaining information from all relevant sources.

- Identifying information by categorizing, estimating, recognizing differences or similarities, and detecting changes in circumstances or events.

- Inspecting equipment, structures, or materials to identify the cause of errors or other problems or defects.

Technician

Technicians will often be asked these tasks:

- Providing documentation, detailed instructions, drawings, or specifications to tell others about how devices, parts, equipment, or structures are to be fabricated, constructed, assembled, modified, maintained, or used.

- Using computers and computer systems (including hardware and software) to program, write software, set up functions, enter data, or process information.

- Servicing, repairing, calibrating, regulating, fine-tuning, or testing machines, devices, and equipment that operate primarily on the basis of electrical or electronic (not mechanical) principles.

Other work activities related to Loan interviewers and clerks

- Verifying and examining information and accuracy of loan application and closing documents.

- Interviewing loan applicants for obtaining personal and financial data and to assisting in completing applications.

- Assembling and compiling documents for loan closings, such as title abstracts, insurance forms, loan forms, and tax receipts.

- Answering questions and advising customers regarding loans and transactions.

- Contacting customers by mail, telephone, or in person concerning acceptance or rejection of applications.

- Recording applications for loan and credit, loan information, and disbursements of funds, using computers.

- Preparing and typing loan applications, closing documents, legal documents, letters, forms, government notices, and checks, using computers.

- Presenting loan and repayment schedules to customers.

- Calculating, reviewing, and correcting errors on interest, principal, payment, and closing costs, using computers or calculators.

- Contacting credit bureaus, employers, and other sources to checking applicants’ credit and personal references.